the Eastgate Market today

by Jonathan Waters

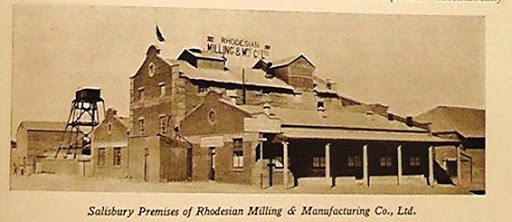

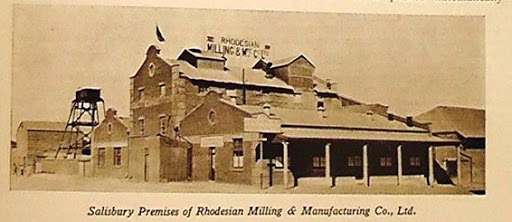

HARARE – July 3, was the 100th anniversary of National Foods if we are to trace the company to its “corporate roots”, when the British South Africa Company (BSA Co) bought into the Mark Harris Manufacturing Co, which became the Rhodesian Milling and Manufacturing Company

(RMMC) in 1924. The first board meeting was held on July 3, 1920, and in 1970 the company took the occasion to celebrate the day as its Golden

Anniversary.

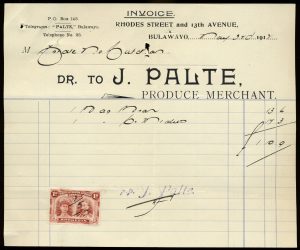

In 1975, what had become simply the Rhodesian Milling Company (RMC) merged with Palte-Harris Industrial Holdings (PHIH), which had listed on the Rhodesian Stock Exchange in 1970, to form National Foods. PHIH had an

even longer history in the milling business – both families that brought the PHIH group together in 1964 had been in the trade for over a half a century by that point, albeit as private companies, with Joseph Palte registering a company in his name in Bulawayo in 1908.

Either way, there are few companies in Zimbabwe that have managed to raise the bat and we should salute Natfoods, the first company to proactively set up a Workers Trust in 1984, for its longevity. 2020 also sees the group mark its 50th anniversary of being listed on the ZSE, and while its

financial performance is hard to measure given Zimbabwe’s bouts with hyperinflation, it is notable that the group has paid dividends in 43 of the 50 years it has been listed.Natfoods is in fact an amalgamation not only of the RMC,Palte and Harris businesses,but also the post-World War

II South African milling operations that ventured into Rhodesia. The National Milling Company established themselves on the site of Natfoods’

Stirling Road premises, while the Meadow Milling Company, in which Tiger Brands was a significant investor, started operations at what is now the

Innscor site on Lytton Road.

All that said, the Palte and Harris families were among the pioneers of commercial milling in what was Rhodesia. The two had a close association from the start as Mark Harris had worked for Palte in Bulawayo before moving to what was Salisbury in 1915 to establish his own operation at

the Atlas Flour Mill on what is Robert Mugabe Road today. After nearly 40 years of being in suspense because of the shear dominance of both

Red Seal and Gloria, Natfoods has recently revived the Atlas

brand.

Having sold the BSA Co a 50% stake in 1920, Mark Harris sold out the balance of the shareholding in 1924. He later went to join his brother Cessey, who had set up his own operation in Bulawayo next to the RMMC factory on Basch Street, selling product under the “Red Seal” brand. In 1956,

the BSA Co opted to buy out the Harris brothers again, a 10 year non-competition clause saw them restricted to maize milling under the Red Seal

brand at their new headquarters on Steelworks Road. In 1964, a three way merger took place between the Palte and Tiger Brands interests in Meadow Milling, and the Harris brothers, to form the Palte-Harris group. Meanwhile RMC, having undertaken an expansion into Northern Rhodesia after World War II and consolidated its dominance on the flour business during the Federation period with the acquisition of the National Milling Company, also ventured into Nyasaland. UDI saw the businesses in the former Federation companies pass to RMC’s major shareholders, Spillers of the

UK and Anglo American, which had taken over the BSA Co’s financial interests in Rhodesia. Once again, the new Palte-Harris entity threatened

the dominance of the larger RMC, which had considered going public in 1965, but it was Palte-Harris that took the jump, listing in April 1970.

In its prospectus issued in March 1970, the investment case was laid bare for the Palte-Harris accounts to be scrutinised by the investing public for the first time.

Profits since 1967 had on balance been good, but had not matched the abnormal results of 1966. The projected 1971 dividend of 2.15 cents would

be 1.47 times covered by EPS of 3.15 cents. At the issue price of 43 cents, the

forecast represented a dividend yield of 5% and earnings yield of 7.33%.

Proceeds from the 2.4 mln shares raising R$1.032m would be used

to pay out the minorities in Meadow Milling and Palte family interests, but

mostly to reduce borrowings in the wake of the expansion in production. On listing, the public would have 30% of the 8 mln shares in issue, with

Tiger Oats and the National Milling Co holding 31.9% between them, while the Harris family held just over 30% with the Paltes owning the 8%

balance.

Market expectations were for Palte-Harris Industrial

Holdings (PHIH) to be 3 times subscribed, but as it turned out

it was 2.2 times as the market was off its 1969 highs. The return of confidence post-UDI had seen five companies listing on the RSE in 1969. In

1970, the only other addition to the RSE was Clan, tradingas Unifreight today.

‘Muchengeti’, the Rhodesian Property & Finance market commentator, said the Palte-Harris public issue was unlikely to attract those seeking a stag profit. “In the present state of the market, the issue price seems well pitched

for the serious investor, who in the long term, should see reasonable growth in capital and dividends. Stags are unlikely to find the issue particularly attractive: the price at first dealing will probably be only

a little above the issue price.” How right he was as the Financial Gazette reported that PHIH got away to “a smooth and steady start”, opening at

45 cents, with later deals at 47 cents. The indication by the time interim results were released in December 1970 was that PHIH would exceed

the projections in its prospectus, having generated 76.1% of its forecast profit in the 6months to September. In the year to March 1971,

it surpassed its forecast $252 000 profit by 68.4% and paid a total dividend of 2.5 cents against the prospectus forecast of 2.15 cents.

PHIH had started milling flour again in 1968 and as the 1970s wore on, RMC

started to see its market share eroded as Red Seal took on Gloria. In 1975, it was announced that PHIH and RMC would merge, with PHIH acquiring RMC for $6.289m (through the issue of 8.254m shares) representing NAV as

at May 31, 1975. The PHIH share price of 76 cents agreed in the negotiations compared with the ruling market price of 80 cents at the time merger

talks started.

The merged entity would be called National Foods, with Anglo and Spillers each having 25% of the enlarged issued equity of 16.5 mln shares,

while Tiger Oats held 16.5%, the Harris family 16% and the investing public the balance of 17.5%. A rationalisation process took place over the next

year, but Natfoods fell short in the year to March 1976 of its target earnings of 11 cents a share, posting 9.07 cents. Benefits were seen in the

years that followed and with the end of the war in sight,

the group started to plan on a post-independence expansion

to take place at its new Aspindale site. By the time the

Stockfeeds plant was completed in 1992, Natfoods had invested Z$64m, a considerable sum at the time. In the year to March 1993, Natfoods reported it had sold 1 mln tonnes of product, a figure that has still

not been surpassed. Profitability almost certainly has never regained these

l evels, if we consider the timevalue of money. In the year

to March 1993, turnover rose116% to Z$1.567 bln (US$260

mln), while pretax profit jumped 159% to Z$203.8 mln

(US$34 mln). Before the disequilibrium in the US$-Z$ exchange rate in 2015, the best performance Natfoods posted was in the year to June 2014,

when turnover amounted to US$343.5m and PBT came in

at US$21.75m.

Anglo exited the business in 2003 when Innscor and its

empowerment partners bought their shareholding. The business was shrunk in the period leading up to the end of hyperinflation and rationalised thereafter, with the oils business exited in 2010. Since

2011 the group has expanded again, with Bulawayo reopening in 2011 along with depots across the country, the same year in which Tiger Brands increased its stake in the group.

The Snacks and Treats business – Breathway – which produces King Korn, Zapnax and Iris biscuits, was acquired in 2016. With new equipment from Buhler, Natfoods launched its Pearlenta porridge last year and has recently reintroduced its Atlas brand, registered as a trademark

in 1918. So after a very successful century, we should

wish Natfoods all the best for the next one.

Natfoods is planning to release a commemorative booklet later this year to mark the centenary of their corporate journey.-TheAnchor