By John Kachembere

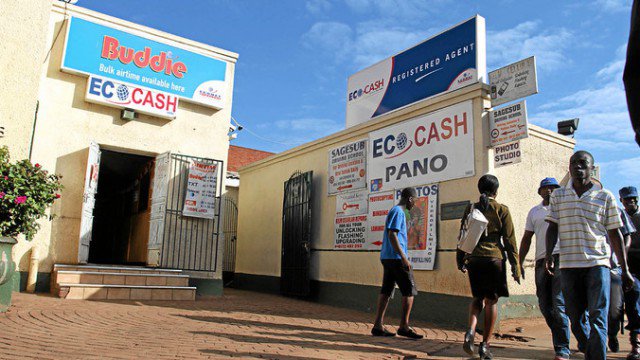

Zimbabwe’s largest mobile telecommunication company by subscriber base Econet’s over six million customers are being denied the opportunity to buy electricity tokens through EcoCash at a time the country is experiencing biting cash shortages.

An investigation carried out by this publication shows that for the past three years Econet has been denied the chance to sell electricity tokens through its mobile money platform, EcoCash, despite assurances from Zesa.

Documents in our possession show that Zesa chief executive Josh Chifamba wrote a letter on April 26, 2016 to Powertel managing director Samuel Maminimini advising him that he “can now connect sub-vendors through EcoCash platform” but the directive was ignored.

Powertel is a subsidiary of Zesa mandated to distribute electricity tokens.

Appalled by lack of action from his subordinate, Chifamba then wrote another letter to Powertel board chairperson Tsitsi Makovah to ensure that Econet was connected to the electricity vending system.

“Subsequent to the meeting held at Zesa…on April 8, 2016 attended by Zesa Holdings chairman, Powertel board chairperson, the group chief executive and consultations with the Ministry, Powertel can now connect to a wider pool of sub vendors in order to expand the geographic footprint for the distribution network of electricity tokens,” Chifamba said.

“As a start, Powertel should focus on connecting to some of the existing sub vendors in order to reduce the tiers in the e-vending structure,” he added in a letter dated May 20, 2016.

“The new sub vendors to be connected should go beyond the existing public and private vendors in order to improve customer convenience. For the avoidance of doubt, Powertel can connect sub vendors using EcoCash,” Chifamba said.

He further argued that the use of EcoCash will enable Powertel to improve its performance by the increase in its current proportion of commissions, where there will be more direct vendors and fewer sub vendors.

This is not the first time that Econet has been denied access sell electricity tokens as the company’s initial request was turned down in 2014 with the then Energy minister Dzikamai Mavhaire stating that electricity vending should remain a preserve of state-owned enterprises.

The reservation was later lifted with many private companies being allowed to partake in the lucrative electricity vending business.

Sources knowledgeable about events at the mobile telecommunication giant said it was surprising for government companies to refuse to utilise private sector efficient systems.

“Considering the country’s cash position you would expect government to want to use the natural commercial incentive that private companies have to implement products like these successfully and to have the platforms running without fail so that both the government and the private company get paid,” the source said.

“One wonders why someone is resisting the directive. EcoCash has over six million customers, which translates to over 80 percent of Zimbabwe’s adult population, and through its 26 000 agents, the platform moved $6,6 billion in one year,” added the source.

Interestingly, Powertel seems to be the only parastatal refusing to work with Econet as other state-owned enterprises such as Telone, Air Zimbabwe, Zinara, National Social Security Authority and Rural District Councils among others are using EcoCash for various transactions.

Economic experts said EcoCash should be an urgent priority for Zesa at a time the government is failing to pay civil servants due to cash shortages.

“All EcoCash agents pay tax, with the mobile platform alone having contributed over $20 million to treasury through various taxes in the year ending February 2016. As such it only makes sense that EcoCash agents be part of the distribution and pay more taxes to the government,” economic commentator Francis Mukora said.

Mukora added that Zesa, through Powertel, was curtailing efforts by central bank governor John Mangudya to promote financial inclusion and the use of plastic money.

The hard-working Mangudya recently instituted various measures such as slashing bank charges and urged banks to increase point-of-sale machines as part of strategies to promote the use of plastic money.

“This is why we have announced that all retailers, wholesalers, businesses, local authorities, utilities, schools, universities, colleges, service stations and the informal sector are required to install point-of-sale machines,” he said.

Efforts to get a comment from Powertel boss Maminimini were fruitless as he was said to be locked up in meetings yesterday and did not respond to questions sent to him by time of going to print. Daily News

1 Comment