Emmerson Mnangagwa’s designate to the Finance Ministry, Mthuli Ncube has introduced a tax that makes it possible for tbe government to take away just about $33 from each person every day.

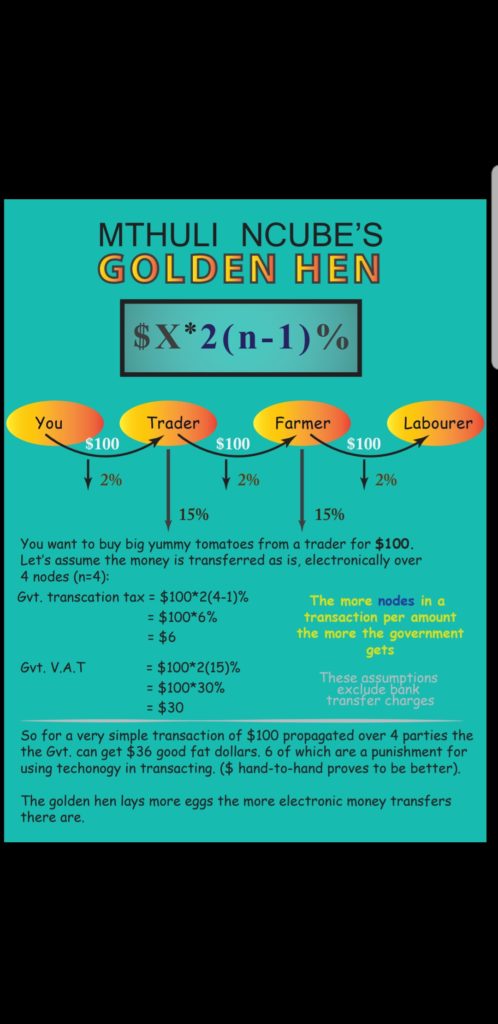

Another contributor, Evans Kanojerera worked the figure out as $36. SEE GRAPH BELOW:

On average citizens in Zimbabwe send money digitally at least 500 times per month.

Please take note of the DAILY TOTAL INSTANCE FACTOR… because nearly every transaction in Zimbabwe is digital, people are forced to send and receive at least 16 times per day. Mthuli Ncube knew of this factor and made it appear as if the tax is just 2 cents. It is not even $2.00 it is $33.00. ( since this is tax not on any production but on a mere transaction).

The calculation is as follows:

Number of transactions per month – 500

Transactions per day (divide by 30 days) – 16.67

____________

Tax Amount paid per day – $33.33 (arrived at using the piling of blame factor).

This tax is on gross amount transacted not income, making it the worst in the world. Mthuli Ncube’s tax hits even the poorest citizens, meaning everyone is treated at

1-The 2% tax will make the average citizen worse off. Mthuli Ncube will charge them for bank-to-wallet transfers & again charge them for further transactions from their Eco-wallet transaction, meaning that’s double taxation.

2-The tax defeats the whole purpose of financial freedom and inclusion for every citizen because it was felt that using mobile money will give most citizens, who now own mobiles an opportunity to manage their money

3-Under the arrangement, business people will not be charged for making transactions between accounts because they have argued that it will make it virtually impossible to continue business if they were to pay the tax considering they operate far too many transactions Mthuli justifies this move by saying he wants to balance the burden of the nation’s economy across all citizens reasoning that business already pay loads of money to inland revenue. This is illegal. Say for argument’s sake someone is getting their pension out of the bank, one would assume they have already been taxed for it, so why should they be further taxed. Same applies to the workers being paid through the bank, Mthuli has said they will not be charged. This is ridiculous because a civil servant for example has earned that money through a service (their job), same as the vendor or mushika-shika who get paid through their respective business. Since the informal traders are not registered as being paid by a formal employing body it means they will bear the burden of Mthuli’s tax. If someone in the diaspora sends money to their parents whose pensions have been eroded by the 2008 inflation and dollarisation, usually the sender has already incurred charges & it just does not seem right to be taxed again to receive that money. I do not understand the purported fairness or balance in this? Business people are aware of a certain levy that is charged by banks for card transactions, this is why for small purchases they don’t accept card payments.

4-If the bank does not even charge for basic savings and instead reward you some interest for entrusting your money to the bank, why should the government then take away your money? We actually need to read between the lines here. In the following clip, it seems like it was the governments intention to promote use of plastic money & in the clip the VP suggested it would be unacceptable to levy charges for transactions. What seems to have happened now, does the government want to raise money by extorting and impoverishing citizens to desperation or do they want to discourage citizens from taking their money out of the bank? Obviously they are aware of the lack of public confidence in the financial system so, when citizens get their money, they are most likely to buy from outside the country since shops are closing.-ONLINE