The economic crisis is so vicious and acute he cannot save himself even if he resorts to violence again

Last week rumours swirled round Zimbabwe that Robert Mugabe, the 92-year-old president, had either died or been incapacitated. The government banned demonstrations after Mugabe’s-presidential aircraft had been diverted in mid-air to Dubai during a scheduled journey to Singapore. Then the man himself turned up alive (though far from well) at Harare-airport, where he made a reasonably good joke about his ‘resurrection’.

The president, who has ruled his country throughout its 36-year history, is nevertheless mortally wounded. We are entering the last few months of the Mugabe era. His health is not the real problem. Zimbabwe is now-spiralling downwards into an economic-crisis so vicious and acute that it leaves no possibility that the president, for all his famed-political skills and notorious readiness to resort to violence, can save himself. The situation is more serious than the hyperinflation of 2008, which was solved by switching to the dollar. This time there is no way out.

The problem dates back to the election of 2013, when Mugabe’s Zanu PF resorted to fraud to win outright victory over Morgan Tsvangirai’s Movement for Democratic Change — and ditched the Government for National Unity, which had governed Zimbabwe since 2009.

Peter Oborne asks ‘What’s next for Robert Mugabe?’:

The GNU, a coalition between Zanu PF and the MDC, had done well. The-crucial-figure was Tendai Biti, one of the greatest-ever African finance ministers. He did not just rescue his country from the 2008 economic crisis. Through good sense, honesty and careful financial management he lifted government revenues from US $280 million in 2008 to US $4.3 billion in 2013, an incredible fourteen-fold increase in just five years.

Biti’s Zanu PF successor, Patrick Chinamasa, has wrecked this fine legacy, and in record time. He returned to the old Zanu habit of using public spending as a source of patronage, for instance allowing the near-doubling of the civil service. To begin with he funded the deficit by issuing treasury bills. But that source had dried up by the end of last year as the money market realised they were next to worthless. Since then Chinamasa has resorted to devious and probably illegal alternatives.

First he plundered the Reserve Bank’s cheque-clearing system. Zimbabwean firms and individuals signed cheques in good faith, only to discover that the payment had not arrived at its destination. Exploitation of the clearing system is thought to have raised about $800 million dollars. But this short-term ruse has had dreadful consequences. The system is now paralysed, while Zimbabwean banks are in practice bust.

A desperate Chinamasa (who received a mysterious visit from former cabinet minister Peter Mandelson, inappropriately accompanied by the British ambassador,-earlier this year) has been forced to look elsewhere. Back in May several exporters were informed, without notice, that part of their foreign earnings would be received in the shape of electronic transfers, which could not be used to make dollar payments. At the same time Chinamasa announced that Zimbabwe planned to return to a local currency, backed by the Afro Exim Bank in Egypt — an idea which lacked an ounce of credibility and was in effect a return to the worthless Zimbabwe dollar abandoned eight years ago.

With the financial system frozen because deposits are liable to be grabbed by the state, a galloping monetary contraction is under way. Less than a year ago a Zimbabwe citizen could remove as many US dollars as he or she wanted from the bank. At the start of 2016 a $10,000 limit was imposed. This was reduced to $2,000 in March and has since fallen to $300, and even that amount is not often available. During three weeks in Zimbabwe, I could not find an ATM which would issue money. Long queues outside banks are a common sight.

Zimbabweans now take dollars outside the country if they can, and hoard them if they cannot. Businesses suspected of hoarding may soon be raided. Some of the country is returning to barter. Elsewhere an informal financial system has emerged. Businesses employ ‘runners’ to take cash to suppliers, avoiding both banks and the government. Of course this has a further knock-on effect on state finances because goods paid for in this way are not susceptible to VAT, duties, customs or taxation. Crucially, however, such payments are not subject to the delays involved in using the official system.

Because subsistence farming is widespread in Zimbabwe, the disappearance of the formal banking system has not had the effect it would have in advanced countries like Britain, where public order would swiftly break down.

However, the effect on government finances has been profound. Many civil servants now get paid in worthless electronic transfers, supposing they get paid at all — an important reason why officials are joining the anti-government riots. Meanwhile the police make good their salary arrears by setting up road-blocks and extorting money from passing traffic (travelling round the country I was stopped numerous times and asked to make payments for road offences I had not committed). Once again this is a short-term expedient, because it deters commerce and frightens away tourists.

With the commercial sector in free-fall and government finances broken, President Mugabe and Zanu PF have only one asset left — their monopoly of violence. This means the army must get paid in full and in US dollars — hence Chinamasa’s unremitting desperation to get his hands on dollars. Even that is a close-run thing. Soldiers received their latest salary two weeks late.

Mugabe could perhaps stagger on for a little while. That would mean a hideous future as Zimbabwe takes a fresh step downwards towards the levels of horror and depravity experienced in Congo — violence borne of desperation leading ultimately to civil war.

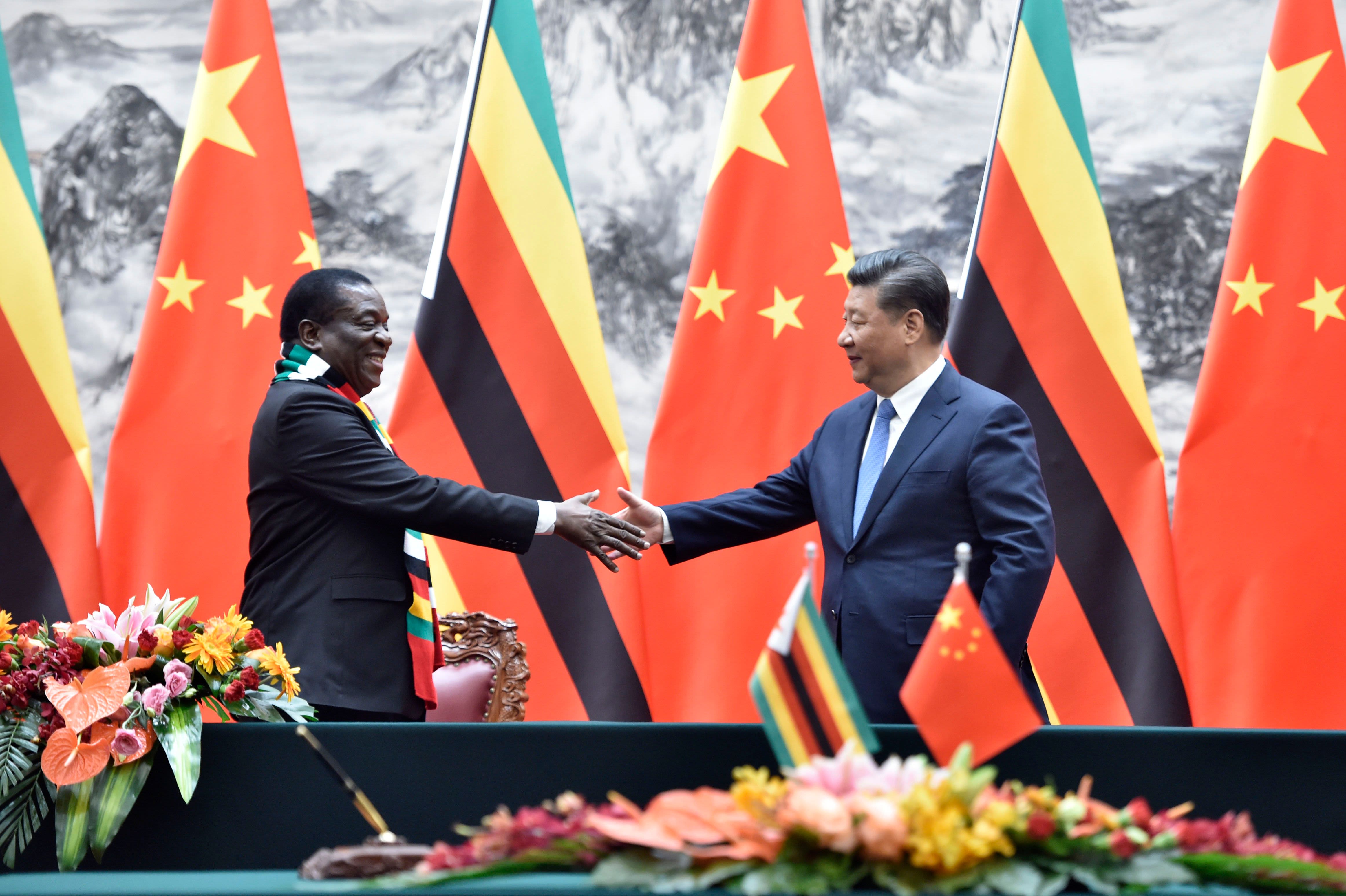

But Zanu PF is now irrevocably split and the president may no long be able to enforce his will. Vice-President Emmerson Mnangagwa, the man who oversaw the Matabeleland genocide 30 years ago, is nonetheless seen by Britain and the West as a man who can push through the economic and political reform the country so badly needs and thus open the way to fresh World Bank funding. New elections, and some hope of fresh politics, loom in 2018.

Robert Mugabe was told by President Julius Nyerere of Tanzania that he had inherited the ‘Jewel of Africa’ when he became leader 36 years ago. He has ruined that inheritance but nevertheless has a chance to quit with some honour in the near future. If not, horror looms.-Spectator