The Reserve Bank of Zimbabwe has allowed the Zimbabwe dollar to fall sharply by 21% this week, a drop that leaves the currency 91% weaker than it was this time last year.

With an anticipated drop in mineral earnings this year and an anticipated bigger import bill in 2024, demand for the USD will likely get stronger, adding more pressure on the embattled local unit.

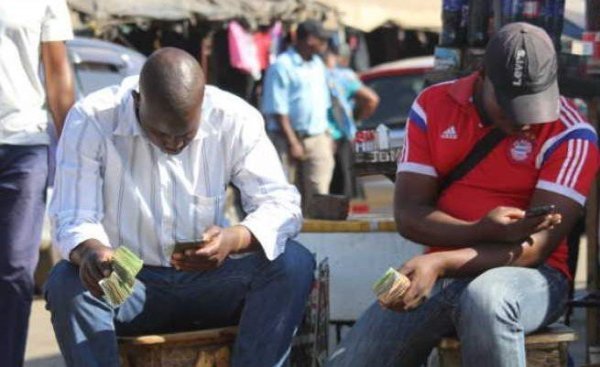

The Zimbabwe dollar traded at Z$8,240 per US dollar on Thursday, down from Z$6,467 earlier this week, according to central bank data. This week’s drop means that the official rate is now more than 91% down over the past year on both the official and black markets. The Zimdollar started 2023 at Z$705 to the USD on the official market and around Z$1,000 at the black market.

Authorities are trying to narrow a widening gap between the formal rate and the more widely used black market rate. The acceleration in the weakening of the Zimbabwe dollar is because of high demand for the US dollar, a member of central bank’s monetary committee has been quoted as saying.

Authorities see a gap of 10% to 20% between the official and unofficial exchange rates as acceptable, Bloomberg reported, citing Persistence Gwanyanya, a member of RBZ’s monetary policy committee.

He blames the drop in the Zimdollar on the end of tobacco sales and a softening of global commodity prices, which have slowed US dollar inflows into the economy.

“Even this quarter, our situation will not have got to normal,” he said. “We will need to manage the demand side, that is deal with the demand for forex and judiciously allocate resources.” With the recent depreciation, the “equilibrium has been disturbed” as the gap between official and unofficial markets exceeds the 10% to 20% range set by authorities, said Gwanyanya. “We will now be seized with re-establishing the equilibrium,” he said.

The Zimdollar’s troubles are feeding in to inflation and making conditions tougher for businesses. Because they are forced to use the formal exchange rate, businesses are taking on bigger exchange rate losses. The exchange rate has seen consumers abandon supermarkets for informal retailers, where US dollar prices are lower.

Currently, businesses are compelled to charge prices within a 10% margin of the official exchange rate. In a policy paper to government, the Confederation of Zimbabwe Industries proposed that they be allow to set prices at 20% below the market exchange rate.

Outlook? Not so good

Will the Zimdollar catch a break? Highly unlikely, given the stormy economic outlook for 2024.

First, Zimbabwe is likely to earn less from mining – which accounts for 80% of Zimbabwe’s foreign currency earnings. The prices of minerals that Zimbabwe sells to the world, such as platinum, have fallen sharply. The impact is already being felt; the country’s earnings fell by 9% in the months to September, mostly due to the weakness in commodity prices.

A Chamber of Mines report late last year forecast mining companies would suffer a 20% drop in revenues in 2023 and a further decline of 10% in 2024. Gold production fell 15% in 2023, as miners struggled with rising costs, power cuts, and hostile government policies. With less money coming into the economy from the main source of forex, at a time demand for USD is rising in a dollarised economy, the Zimdollar will come under more pressure in the coming year.

Demand for USD will also increase due to the need to import some commodities, as a result of the drought, and to pay for power imports. Global inflation, and high oil prices, also mean that Zimbabwe will spend more on imports. This will add more demand for US dollars, and more trouble for the Zimdollar.-newzwire